The Evolution of Life Underwriting

Not so long ago all policies were traditionally underwritten, while this allowed for the lowest premiums and broad face amounts, it also required an extensive health questionnaire, an invasive and time consuming medical exam and often weeks, if not months, of waiting for a decision. This high-touch, time-consuming process was at odds with consumer expectations....

Read More

The Evolution of Life Underwriting

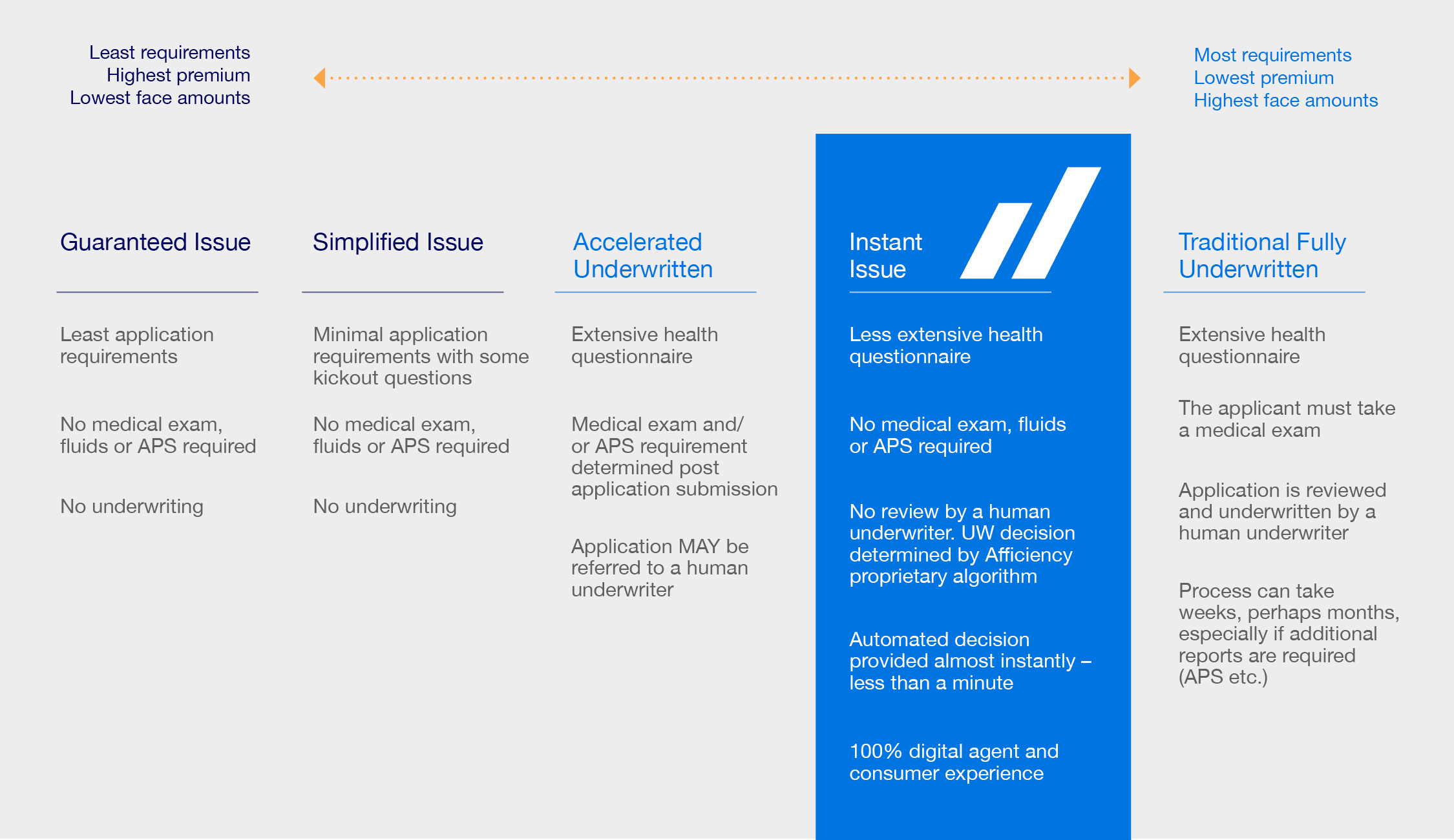

Not so long ago all policies were traditionally underwritten, while this allowed for the lowest premiums and broad face amounts, it also required an extensive health questionnaire, an invasive and time consuming medical exam and often weeks, if not months, of waiting for a decision. This high-touch, time-consuming process was at odds with consumer expectations. It is not surprising that the proportion of policies traditionally underwritten has continued to decline over the last several years.

At the opposite end of the underwriting spectrum are guaranteed issue products – characterized by no underwriting, minimal application questions or medical exam, guaranteed issue products are limited by lower face values and higher premiums.

Coupled beside guaranteed issue life products are simplified issue products – slightly higher face values and lower premiums are offset with marginally more application questions, with some knockouts, without the need for medical exams or underwriting.

Accelerated underwriting has been in vogue for several years, with many if not all life carriers now offering a line-up of products that rely more heavily on data and analytics to drive their underwriting decision. However the consumer may still be required to undergo a medical exam, provide an APS and/or be referred to a human underwriter, more akin to traditional underwriting. As a result, products under the accelerated underwriting umbrella can offer greater face values and lower premiums relative to their simplified and guaranteed issue cousins.

Where does Afficiency fit in?

Recognizing the ongoing need for higher face values, lower premiums and timely decisions, the Afficiency product portfolio is well positioned with instant issue life products, designed to deliver easy to understand life insurance policies. Featuring:

Read Less